Why Political Balance on Supreme Courts Matters

June 21, 2011

By Kathy Groob

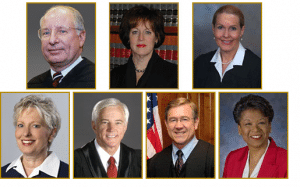

The 2010 elections resulted in a Republican-dominated Ohio Supreme Court, with six of the seven justices from the GOP. The lone Democrat – and newest member of the court – is Justice Yvette McGee Brown, who shared the campaign ticket with Governor Ted Strickland. Before leaving office, Gov. Strickland appointed Brown to fill the seat that was vacated as a result of Maureen O’Connor’s successful bid for Chief Justice.

O’Connor is the first female Ohio Chief Justice, and Brown is the first African-American female justice on the court.

While the Ohio Supreme Court makes history with its first female African-American justice and the first female chief justice, the court has no semblance of political balance. Politics has no place in our justice system, but in reality, it is very much alive and well and the need for balance is critical to the administering of justice. Personal experience taught me the significance of judicial balance.

In 1997 my husband and I pursued a business acquisition from a pump rental company owner ready for retirement, who did business the old-fashioned way with a handshake; gentlemen’s agreement. After a lengthy financial evaluation period, my husband agreed to purchase the company and sought to obtain financing for the purchase from the owner’s bank, KeyBank of Ohio. “Who better understands the financial health of a business, than its own bank?” he thought.

After meeting with the bank vice president who was the bank officer, Carol Sapinsley Sarver, for the pump company, the bank VP replied to my husband and his partner “you’ve found the goose that laid the golden egg,” referring to the financial health of the pump company. While the owner did not have the most sophisticated of financial systems and records, he did make a healthy profit and had a built a solid business. My husband and his partner shared their complex spreadsheets, projections and financial analysis with the bank officer.

After meeting with the bank vice president who was the bank officer, Carol Sapinsley Sarver, for the pump company, the bank VP replied to my husband and his partner “you’ve found the goose that laid the golden egg,” referring to the financial health of the pump company. While the owner did not have the most sophisticated of financial systems and records, he did make a healthy profit and had a built a solid business. My husband and his partner shared their complex spreadsheets, projections and financial analysis with the bank officer.

A few days later, my husband was abruptly turned down for the loan citing no specific reason, just NO. Shortly after, the owner decided not to spend any more time negotiating with my husband and his partner because he had suddenly found another buyer. After much disappointment and financial setback, my husband and his partner eventually gave up pursuing the deal. My husband returned to his consulting practice, which had slipped while he spent so much time on the pump company deal, and was unable to find another suitable company to acquire that was as good a fit as the pump rental company.

Fast forward two years later, while reading the newspaper one Sunday morning, my husband saw in the obituaries that the pump company owner had died of cancer. Sympathy quickly turned to anger when he read a quote by the new owner of the company, Key Bank vice president female loan officer Carol Sapinsley Sarver, the very loan officer who inexplicably turned him down for a business loan. Immediately he took action and wrote a letter to the local bank president inquiring how this could have happened, “How could the loan officer be permitted to buy the company?” She knew nothing about the real opportunity to purchase the pump company until the day my husband and his partner walked in to lay it out for her. Her role was supposed to be that of a trusted loan officer, not a competitor who used her position in that role to obtain information to steal the deal!

Hearing no response from the bank, my husband wrote to the president of the state-wide Key Bank Corporation. After receiving no reply, he consulted with an attorney where he quickly learned that not only was the bank officer prohibited by the bank’s code of ethics to become involved in any self-dealing with a client or prospective client, but that what she did was illegal because she interfered with an active business deal. Ultimately, my husband, his partner, and I sued Carol Sapinsley and KeyBank for interference with a business opportunity and breach of fiduciary duty.

At the end of a two-week trial in 2001, the trial judge released KeyBank from all responsibility, while finding that the former bank employee, Carol Sapinsley, was responsible and ordered her to pay more than $556,000. By that time, Sapinsley had driven the pump company into the ground, divorced her husband, entered the business with a partner who was her lover and was nearly bankrupt. We we never did receive the $556,000.

Our attorneys filed an appeal citing five areas where the trial judge had erred in his decision to let the bank off scot-free. It was December 2003 before the Ohio Court of Appeals took the case. The Appeals Court ruled by a 3-0 vote in our favor and remanded the case for a new trial in the lower court on the issues of beach of confidentiality and their responsibility for the actions of its employee, with new instructions for the jury.

Next, KeyBank filed an appeal with the Ohio Supreme Court and a decision was finally reached three years later on March 29, 2006. By a 4-3 decision our case was finally over. Ohio’s Supreme Court found in favor of KeyBank stating that the bank did not owe any fiduciary duty to prospective clients. End of case; end of story. I think of it as a cautionary tale.

But the story didn’t end there. We later learned the political affiliations of the Supreme Court members and that the four justices who found in favor of the bank were all Republicans and had each been past recipients of campaign contributions by executives of KeyBank executives and the Key Corp Political Action Committee.

Why did the four justices rule and agree that a bank has no responsibility to protect the confidential financial information of a prospective customer? Was it ideology, political affiliation, or similar interpretations of the facts? From our perspective it’s hard not to believe that political affiliation and candidate associations came into play in the justices decision. Without balance on our court, can we ever be sure justice will be fairly served? Will partisan politics determine judicial outcomes? Do politics play out on the bench just as they do on House and Senate floors.

Judicial decisions impact us every day. They impact our finances, our livelihood, and our personal freedoms. It is a sad commentary that increasingly we must raise a brow to what has become the politics of justice. Remember our cautionary tale and please pay attention to who is sitting on your State Supreme Court bench, or better yet, when candidates are running for election.

Click here to watch the deposition of KeyBank President Jack Kopinsky.

RELATED LINKS

KeyBank related contributions to Supreme Court members since appeals verdict